There are various things that a business needs in order to scale, from the right talent to access to overseas markets. One thing that’s hard to overlook is finance however. Whilst many reports have explored the scale up requirements of startups, few have examined the issue from the perspective of the investor, which makes a recent report from the British government so interesting.

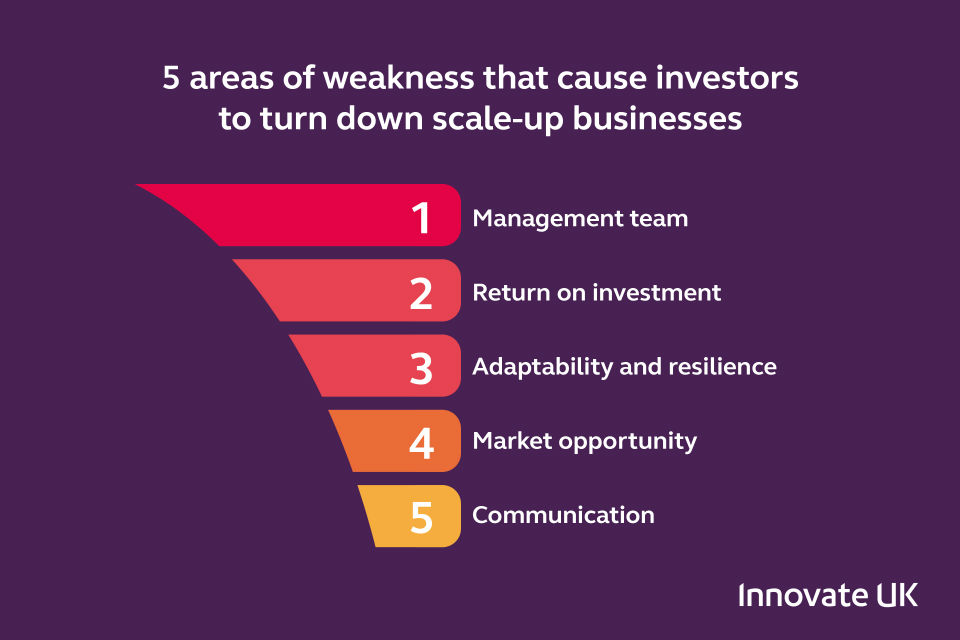

The report finds a fundamental mismatch between things the startup believe to be important, and those the investors do. For instance, contrary perhaps to perceptions, the investors were very keen on ‘softer’ aspects of their relationship with the startup, demanding a strong chemistry with the entrepreneurs and exceptional communication. They also wanted the companies they back to be adaptable to change and resilient to shocks.

The importance of managers

Where there was convergence was on the perceived need for top quality managers, with both entrepreneurs and investors finding this crucially important. The most important qualities investors look for in a management team are passion, resilience, drive, adaptability and ambition.

Alongside a strong management team, investors also regarded strategy, vision and a robust demand from the market as key elements they look for when helping a startup to scale.

Arguably the most important finding from the study however was the constant disconnect between what the businesses and investors thought were important. For instance, twice as many businesses thought a speedy exit was crucial as investors, whilst cultural fit was much more important for investors than it was deemed to be by businesses.

Plans for scaling up

So how are many businesses looking to scale up? Perhaps unsurprisingly, many are looking to overseas markets in order to expand. The study found that 92% of businesses are either currently exporting or planning to do so. However many worry that they lack the contacts and local market knowledge to successfully do so.

It’s a topic I touched on in a recent post that explore the EU’s EIT community, which offers a pan-European network of startup support in a wide range of sectors. By having hubs around Europe, they aim to offer startups all the help needed to tap into markets across the EU.

Collectively, they work with nearly 600 startups, 200 universities and 152 research labs spread across 83 cities in Europe. It’s a collaborative approach that seems to be working. The startups in their network have raised in the region of €600 million in external funding, and have gone on to create over 6,000 jobs.

It’s something that was also identified in a recent study of successful Wharton alumni, and that venture funds and incubators have been increasingly trying to offer. The scale and breadth of the network offered by an organization such as EIT is tough to match however, as it offers the potential of significantly easier access into all 28 markets within the EU.

More and more countries appreciate the importance of helping startups to scale, and therefore more attention is being given to the kind of things needed to help this happen. This insight should go a long way towards ensuring that the fresh ideas and innovations the global economy so crucially needs are in steady supply.