As crowdsourcing has taken off, there have been numerous attempts to try and understand who engages in crowd based activities, what motivates them, and how they go about their work. One area that hasn’t received quite such intense scrutiny is in the crowdfunding market.

That isn’t to say that the market hasn’t been studied of course. There have been studies comparing crowdfunding with venture finance, explorations of successful campaigns, and even whether discrimination existed in crowdfunding.

In terms of exploring the actual investors themselves however, a recent paper is probably the first to venture into that territory.

The research especially wanted to explore whether there were any visible differences between frequent backers and more irregular ones. Was there anything that distinguished the heavyweights from the hobbyists?

Suffice to say, if you’re looking to attract serial investors, then understanding a bit more about who they are is pretty valuable.

The researchers trawled through three months worth of Kickstarter data, and found that backers tend to fall into one of two camps.

- frequent investors

- occasional backers

The team then set about trying to understand what it was about a project that attracted each type.

“Users that act like investors, they tend to focus on progress in technology or games,” the researchers say. “Projects in other categories tend to be attract [less frequent] donors.”

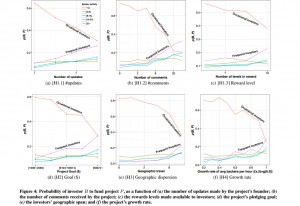

The study came up with a number of qualities that frequent investors tend to go for in a campaign, which may prove useful when setting up your own project:

- High goals – if a campaign has a big funding target, it seems more likely to attract frequent investors

- Broad appeal – likewise, if the target market is relatively wide, then the higher prospects of a return lure in the big investors

- Strong management – interestingly, the research found that investors are often backing the team as much as they are their project. A well designed and managed page can help communicate that quality.

- Rapid growth – I mentioned at the start of the post a previous study that found how early investment tends to beget subsequent success. This study came to a similar conclusion.

You can see the findings from the study in graphical form below (click for full size). Suffice to say, we should always be careful about drawing too firm a conclusion from a single study, but it is interesting nonetheless.